National Pension System

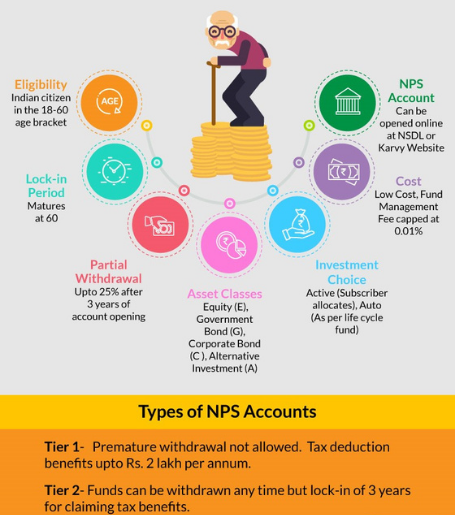

The Central Government had introduced the National Pension System (NPS) with effect from January 1, 2004 (except for armed forces). Pension Fund Regulatory and Development Authority (PFRDA), the regulatory body for NPS, has appointed NSDL as Central Recordkeeping Agency (CRA) for the National Pension System. CRA is the first of its kind venture in India which is carrying out the functions of Record Keeping, Administration and Customer Service for all subscribers under NPS. CRA shall issue a Permanent Retirement Account Number (PRAN) to each subscriber and maintain database of each Permanent Retirement Account along with recording transactions relating to each PRAN. In NPS, a government employee contributes towards pension from monthly salary along with matching contribution from the employer. The funds are then invested in earmarked investment schemes through Pension Fund Managers.

Who should invest in the NPS?

The NPS is a good scheme for anyone who wants to plan for their retirement early on and has a low-risk appetite. A regular pension (income) in your retirement years will no doubt be a boon, especially for those individuals who retire from private-sector jobs.A systematic investment like this can make a massive difference to your life post-retirement. In fact, Salaried people who want to make the most of the 80C deductions can also consider this scheme.

- Returns/Interest

- Risk Assessment

- Tax efficiency – NPS tax benefit

- Withdrawal Rules After 60

- Early Withdrawal and Exit rules

- Equity Allocation Rules

- Dual benefit of Low Cost and Power of compounding

The scheme encourages people to invest in a pension account at regular intervals during the course of their employment. After retirement, the subscribers can take out a certain percentage of the corpus. As an NPS account holder, you will receive the remaining amount as a monthly pension post your retirement.